Sustainablewith APHAutomated Position Hedger

FWX with APH acts like a dealer, accepting any derivative orders from users without any opposition matching.

Benefits of APH

How APH works

APH starts operating after a user submits a Long or Short position to FWX DDEX

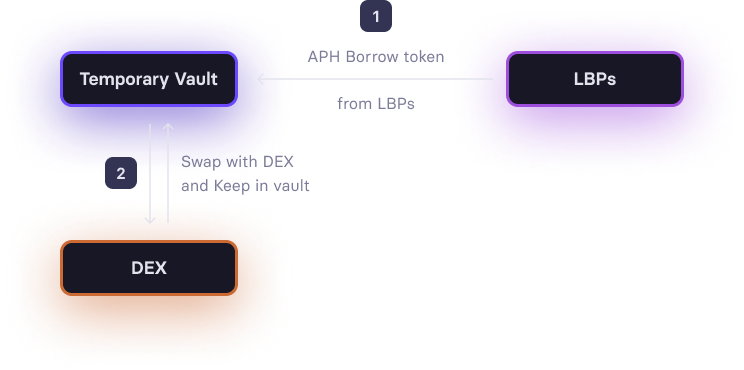

1

The protocol will borrow the pair of borrowed tokens from the LBPs (Lending & Borrowing pools).

2

Then, it swaps tokens with the same token of order and keeps it inside temporary vault until the positions are closed.

After the positions are closed, the protocol will reverse the mechanics back; swap, return, and give the profit to the user or take the loss from the user,

therebyeliminating the risks to the protocol.